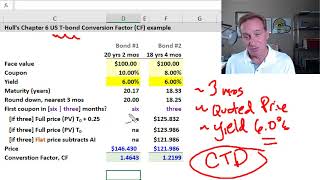

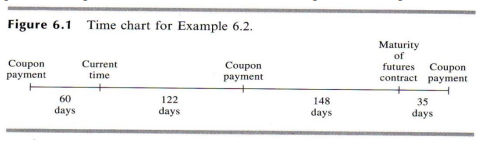

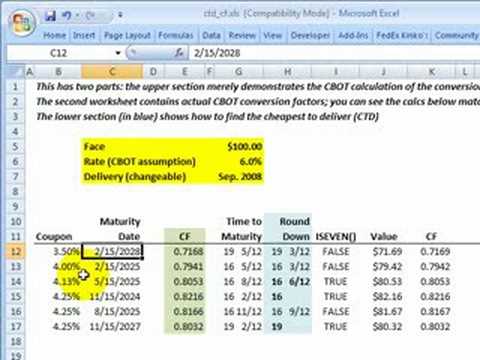

Calculating U.S. Treasury Futures Conversion Factors Final Dec 4 | PDF | Futures Contract | United States Treasury Security

𝐄𝐟𝐟𝐢𝐜𝐢𝐞𝐧𝐭 𝐌𝐚𝐫𝐤𝐞𝐭 𝐇𝐲𝐩𝐞 on Twitter: "So in simple terms, the implied repo rate is the implied money market return from a cash and carry trade. And for a treasury futures seller, that

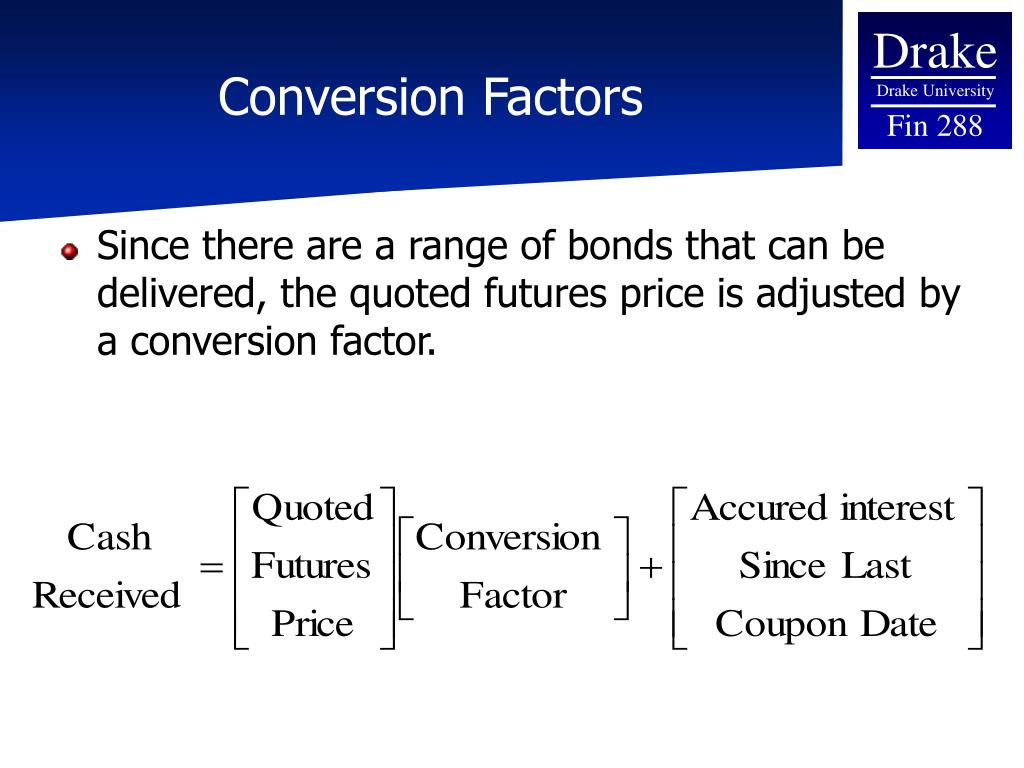

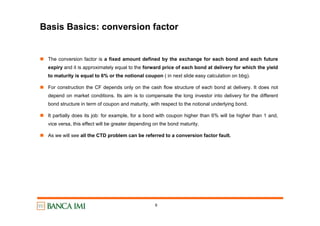

𝐄𝐟𝐟𝐢𝐜𝐢𝐞𝐧𝐭 𝐌𝐚𝐫𝐤𝐞𝐭 𝐇𝐲𝐩𝐞 on Twitter: "The CTD's risk value of 6.976 is then divided by the conversion factor 0.8338 to arrive at 8.367 which is the price risk of the future based